The Lowes UK Defined Strategy Fund has a target return of exceeding returns earned on cash (as measured by the Bank of England's Sterling Overnight Index Average ("SONIA") + 5%).

The Fund aims to achieve the targeted return by investing in a diversified portfolio of equity related securities, government and investment grade bonds and indirectly in these securities through Financial Derivative Instruments. These strategies are based on those typically found in structured investments.

In part, the appeal of structured investments is the defined nature of the potential return, whereby investors may become informed of the limited range of outcomes before making an investment. Details for structured investments are shown in a Key Investor Information Document (KIID), and the respective product brochure. Such investments can however be subject to 100% capital losses. The difference between structured notes and equities is that structured notes may reduce volatility due to the derivative based nature of the strategies; whilst equities have the benefit of producing dividends which may partially offset losses made.

To mitigate the potential for capital loss in the longer term, some strategies have a maximum investment term of ten years, increasing the number of early maturity observation points.

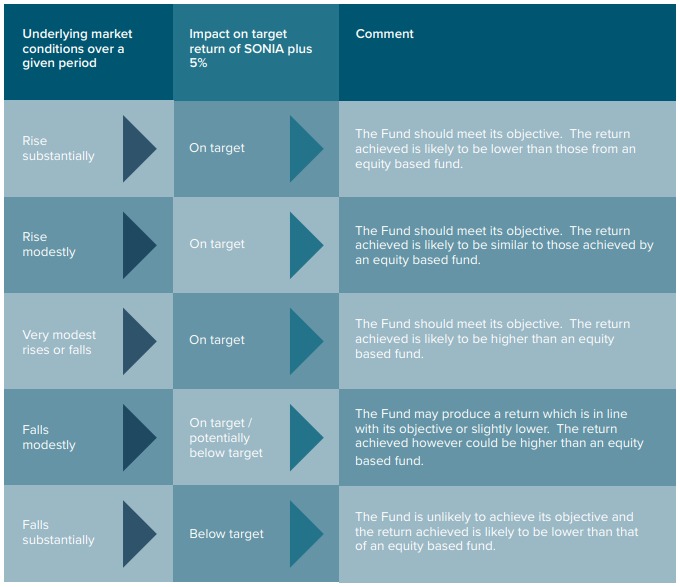

So, how could investors expect the Fund to perform under different market scenarios? The below table summarises the expected return outcomes, based upon various statistical simulations using scenario analysis techniques to determine what the most probable outcomes are, based on a large sample of repeated simulations on the FTSE 100 Index, which will be the core underlying index of the portfolio, as described in the prospectus for the Lowes UK Defined Strategy Fund.

Source: Lowes UK Defined Strategy Fund Brochure – Page 7. Simulated returns do not represent actual performance of assets during the referenced period and actual returns may differ significantly from the simulated returns presented.

This table suggests that the Fund may not always meet or exceed the targeted return; during modest or substantial falls, certain strategies may not pay out, however each strategy contains a capital protection barrier to try and protect the capital position of the Fund to the point of the index falling by as much as 40% from the starting price level when the strategy begun. However, the extent of capital protection offered does vary between the strategies used. If you would like to know more about the Lowes UK Defined Strategy Fund, please visit the Fund website or call Lowes Investment Management on 0191 281 88 11. The Lowes UK Defined Strategy Fund is a sub-fund of the Skyline Umbrella Fund ICAV and is regulated by the Central Bank of Ireland. This document should be read alongside the KIID, Prospectus, and Fund Supplement which are available on the Fund website UKDSF.com/Literature and from your financial adviser.

Further Information:

This article is for information purposes only and should not be construed as advice. We strongly suggest you seek independent financial advice prior to taking any course of action.

The value of this investment can fall as well as rise and investors may get back less than they originally invested. Past performance is not necessarily a guide to future performance.

The Fund is suitable for investors who are seeking capital growth over a medium to long term horizon but who are willing to tolerate medium to high risks due to the potentially volatile nature of the investments.

The information within this document does not relate to the personal circumstances of any one individual. It is recommended that investors seek independent advice, where necessary, before making any decision to invest or indeed, to subsequently disinvest.

Lowes has taken all reasonable steps to identify conflicts of interest that may exist in our role as investment manager to the Fund and as a financial adviser to our clients who may have invested in the Fund. We have policies in place to ensure that your interests as investors in the Fund remain paramount and over those of our own. In recognition of this any portion of the Fund management fees that would ordinarily be due to Lowes in respect of an investment in the Fund by a client paying Lowes for ongoing advice in respect of their holding will not be paid to Lowes but will be redirected to UK registered charities selected by the Lowes Charity Committee.

The content of this article has been written and prepared by Lowes Investment Management Ltd. The document should not be relied upon as a forecast, considered research, or an offer to buy or sell securities with respect to any investment vehicle. The purpose of this article is purely to provide information on the Fund. No liability is accepted for the accuracy or completeness of any information and opinion contained in this document which may be subject to updating and amending.

Lowes Investment Management Ltd, Fernwood House, Clayton Road, Newcastle upon Tyne, NE2 1TL. Authorised and regulated by the Financial Conduct Authority.