About the fund

The Lowes UK Defined Strategy Fund is an actively managed fund comprising a number of defined investment strategies where the potential returns earned within the Fund are typically fixed in nature and linked to the performance of one or more established stock market indices, such as the FTSE 100.

The Fund is managed by Lowes Investment Management Limited and capitalises upon skills and structured investment selection success enjoyed by Lowes clients, built up over several decades.

Fortem Capital Limited acts as investment adviser to the investment manager, providing information, guidance and assistance with risk management.

The Fund is authorised in Ireland by the Central Bank of Ireland.

The value of investments can fall as well as rise. You may get back less than you invested.

Investment Selection

The investment managers at Lowes have been selecting the types of strategies included in the Fund for many years, with clients seeing this through recommendations to invest in one or more structured investment plans. The Fund builds on this concept, offering investors exposure to several investment counterparties and a range of potential durational returns, all linked to the performance of established market indices.

The style of investment favoured by the investment managers is called the autocall or ‘kick-out’ which, although they can be for as long as ten years, have earlier return trigger points whereby the investment return is crystallised and subsequently reinvested.

For illustration, it is quite possible that the investment managers may invest in a strategy that has a maximum duration of up to say, eight years. However, should the FTSE 100 Index be at or above its starting level after two years, it would pay its return at that point, albeit a return less than may potentially have been returned had the investment continued.

The investment managers repeat this process and expect the Fund to have exposure to many such strategies at any given point in time, all at different stages in their investment lifecycle. Through this process the Fund’s investments are then diversified not only in terms of investment counterparties but potential return profiles.

The investment managers have full discretion as to the investments they select; potential returns, duration and counterparties. They may also decide to sell investments ahead of a potential return date, should it represent good value on a comparative basis, e.g. where strong market performance implies that an earlier return would be more profitable.

The use of capital protection barriers mitigates, but does not eliminate, the risk to capital in the event of a prolonged market downturn.

Example of a typical strategy

The Fund invests in many strategies and the diagram below shows returns from one potential strategy within the Fund, based on the FTSE CSDI Index.

Please note that the above example is for illustratory purposes only and that the strategies employed may vary from the above to reflect market conditions at the time of investment.

The example used was typical of what may have been possible based on market conditions in June 2024.

It also assumes investment in the strategy was made at inception and was held continuously until it ceased after 8 years at the latest.

Individual strategies may be dependent upon named banks meeting their obligations.

Why such strategies?

The strategies being utilised are based on those found in structured investments. Such investments have been a feature of the investment landscape since the late nineteen-eighties and have, over time, settled on a form that offers investors a fixed return depending on certain performance criteria, with the potential to mature early if certain market conditions prevail. In the UK the reference asset is most often the FTSE 100 Index, where the return would be triggered if the Index was, say, at or above its initial level on an anniversary date. Returns are pre-defined, fixed and accrue the longer the investment remains in force.

The appeal of structured investments is the defined nature of the potential return. Such investments, like equities, can be subject to capital losses. Unlike equities, the potential for such a loss is defined. However, equities will potentially have the benefit of producing dividends which may partially offset any losses made.

To mitigate the potential for capital loss, Lowes has led the move towards longer-duration structured investments. This increases the number of earlier return opportunities, and the potential for capital loss being observed after eight or ten years, and then only if the investment has not matured at an earlier observation date.

It is the fixed-return element of a structured investment, along with the potential to mitigate risk to capital that allows a fund such as the Lowes UK Defined Strategy Fund to target such competitive returns. Be aware that capital is still at risk.

Leveraging for our experience in the structured investment sector, the Fund allows us to offer investors access to a diversified pool of assets akin to structured investments but is begs some questions, namely:

Ways in which the Fund differs from traditional structured investments?

1. The fund has the potential to create and sell strategies based on market conditions and take advantage of favourable pricing in periods of volatility. In a nutshell, the investment manager is in full control of when trades in the Fund are placed and with whom.

-

2. The Fund will benefit from more efficient pricing than would be available to investors for a number of reasons:

- - The Fund will invest in institution size trades which, by definition come at a much lower cost than retail investments offered for a minimum investment size of say, £3,000. The lower charges translate to enhanced terms for the investments acquired by the Fund.

- - The investment manager doesn’t have to wait for a strike date sometime in the future, this waiting time found in retail investments comes at a cost to the provider and is reflected in a lower coupon than could be secured immediately. Why? Simply because the provider is exposed to changes in market conditions between launch and strike whilst at the same time has effectively guaranteed terms to investors.

- - The Fund does not have to carry out the retail administration for each and every one of its investments.

- - The Fund will invest on a competitive tendering basis for elements of the structured investment or strategy, leading to better terms than being tied to any one counterparty.

- Diversification across multiple institutions means any one single instrument failure should have a lesser impact than for a single structured investment.

- Diversification across multiple observation and strike dates means that there is less importance attaching to any one particular date leading to a spread of outcomes; however, in comparison with a single and successful structured investment, the return from the Fund is expected to be less over the same period, but over the long term the Fund should outperform a portfolio of structured investments because of better terms and diversification of risk.

5. The Fund will provide daily liquidity to investors, except in extreme market conditions. Perhaps not a feature of retail plans but retail plans have in the past offered weekly or even monthly disinvestment and often with a charge.

6. With the Fund, investors will not experience an ‘out of the market’ period following a maturity. If reinvestment was the advice recommendation the investor could be out of the market for as long as 8-12 weeks and it assumes a suitable opportunity is available.

7. Structured investments are typically off-platform meaning that they are difficult to monitor and model within a portfolio solution, the Fund on the other hand is on-platform and therefore can be assessed alongside other investors.

8. The FCAs steer that structured investment exposures should be limited to 10% to one counterparty and 25% in total shouldn’t apply to the Fund, meaning you can gain wider or additional exposures to the same investment strategies via the Fund.

9. The Fund is a permitted investment for an offshore bond; a structured investment is caught by the highly personalized portfolio bond rules, which all but rules it out from offshore bonds.

10. Expert selection and management by Lowes Financial Management who have two decades of experience within the retail structured products sector.

When would you recommend a structured investment over the Fund?

The Fund can largely be put in the ‘steady as she goes box’, no surprises and hopefully solid performance. The structured investment on the other hand should be viewed differently, perhaps more of a tactical, satellite or potential booster play as part of an overall portfolio strategy. If the terms are right, and there is a considered view that say an autocall investment has a high likelihood of maturing in say double figures after a reasonable time, then why not? However, it is prudent to assume that the Fund will also have access to the same or even better pricing conditions, but its ability to react will be constrained by its risk management process and available cashflow.

What is the targeted return of the fund and how was it arrived at?

The targeted return for the fund is in excess of 3-month LIBOR + 5%.

Cash +5% was arrived at as this is generally accepted to be within the real return range achieved by equities over the long term. Indeed, if we were to look at the 2018 Barclays Equity Gilt Study, the summary table confirms that the real return posted by equities is 5.1%; this compares to 0.7% for cash as an asset class.

Cash +5% is a measure which has also been adopted by other funds as a measure, although admittedly in different sectors and employing different strategies. For example, SLI GARS looks to achieve a return on equities with two thirds of the volatility. As a measure of equities, they see cash +5% as a suitable target.

Some funds use the alternative CPI + type comparator rather than cash +. However, if you took cash as the risk-free rate, the +5% should in theory highlight the increase in risk you are taking to achieve this (risk premium).

Regarding time horizon the recommended minimum holding period should be at least 5 years.

The target duration for strategies in the Fund is between 5 and 10 years, structured with the potential to receive an earlier return.

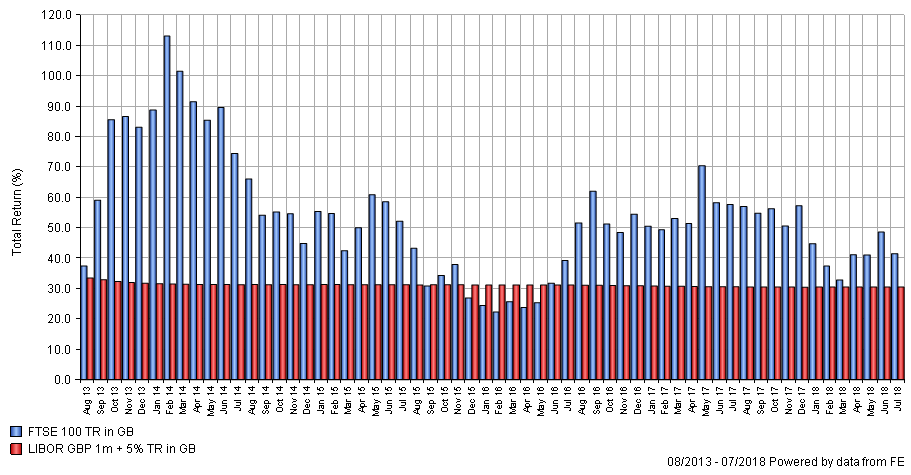

The chart below shows recent rolling 5-year periods for the FTSE 100 (TR) and LIBOR 3m +5% as a proxy for cash (source: FE Analytics).

Even ignoring the earlier periods of the chart, where the FTSE 100 would have been measured from the 2009 lows, we can still see that equities, even represented by just this index, have achieved cash +5% on a rolling 5-year basis.

If equities are falling, we would expect investors to compare the performance of the Fund to equities and not necessarily the cash +5% target. We would expect the fund to have a delta to a falling market of about 70%, meaning that we expect the fund to outperform in falling market conditions.